.png)

Creating an effective financial plan is essential no matter who you are or what stage of life you’re in. According to brightplan.com, having organized financials can help you improve your confidence, peace of mind, and reach both long-term and short-term goals. However, if your life becomes complicated by a chronic condition like COPD, you might find that financial planning is a lot more time-consuming and less straightforward.

Not only does COPD come with a lot of added costs like doctor’s visits, medications, and oxygen devices, but it also leads to added stress, anxiety, and worry; all of which can make it feel overwhelming to create a financial plan. Luckily, the more you educate yourself about your disease and the common financial mistakes that COPD patients make, you’ll be well on your way towards creating a more secure long-term plan.

Here at LPT Medical, we take pride in offering cost-effective long-term solutions for your supplemental oxygen needs. We offer a wide selection of portable pulse dose and continuous flow oxygen concentrators, stationary oxygen concentrators, as well as oxygen accessories that help you get the most out of your purchase. Read on to learn about some actionable tips for saving money as a COPD patient and be sure to reach out to us if you’re interested in an oxygen machine.

{{cta('fa8abc2a-1e88-4fa3-82fd-1cb5b9ed43b2','justifycenter')}}

Reduce Living Expenses

If you think about it, a lot of your money goes into essential things like your monthly rent, food, gas money, car repairs, and insurance. But just because these things are necessary does not mean that you can’t save money on them. In fact, according to a CNBC article from last year, on average, people spend $143 more than their budgeted weekly allowance. And while this may not sound like a whole lot, that adds up very quickly accounting for over $7,000 each year.

Another thing associated with living expenses is that many people assume they only affect younger people. People that are just out of high school or college are oftentimes more aware of their monthly living expenses because they don’t have that much money saved up. As a result, they need to be more frugal in the way that they use things such as utilities or how much they use their car. As we age, however, it’s easier to overspend on living expenses because we have more of a financial safety net.

One popular trend that’s being embraced by many seniors is something called “downsizing.” Simply put, this is the process of significantly reducing your expenses by getting rid of things that you don’t need. In some cases, downsizing could even mean moving from your current home into one that is physically smaller and less costly. By doing so, you’ll be able to save up more money each month for things like doctor’s visits and COPD medication.

Another living expense that COPD patients may struggle with is the prospect of applying to a nursing home. According to AARP, a nonprofit organization designed to support people over the age of 50, the cost of long-term care options like nursing homes is skyrocketing. Because of this, many people with disabilities are opting for cheaper options that don’t break the bank.

Reduce Unnecessary Spending

Unnecessary spending differs from living expenses in the fact that they are not essential. This includes things like subscription services, gym memberships, cigarettes, or any other type of “luxury” product or service. The problem is that nowadays it’s so easy to spend money. Online shopping has become such a common way for people of all ages to pass their time but it’s also very easy to lose track of how much you’re actually spending.

Cigarette smoking is another expense that can really add up over time. Believe it or not, around 38 percent of people with COPD still smoke despite the fact that 85 to 90 percent of COPD cases are the result of smoking. What’s more, smoking a pack a day can run you around $2,292 each year. Not to mention the fact that continuing to smoke while you have COPD will increase your risk of experiencing an exacerbation and cause your diseases to progress more quickly. Inevitably, this will lead to more medical expenses.

Another unnecessary expense that many people fall victim to is subscription services. It seems like just about every product or service nowadays is bound to a subscription payment in hopes that consumers will start one and forget they have it. Unfortunately, this is usually what happens. Take some time to go through your bank statements and identify any recurring costs, and if they aren’t absolutely necessary then you should eliminate them.

Limit Hospital Visits

By far the biggest expense for anyone with a disability like COPD is a hospital visit. You may be surprised to find that the average hospital visit costs the patient $10,000 and hospital stays are responsible for 60% of all bankruptcies. With this information in mind, it should be your number one priority to prevent medical emergencies that facilitate a need to visit the emergency room.

The best way to prevent medical emergencies related to COPD is to follow your COPD treatment plan and avoid exacerbation triggers such as smoke, pollution, and other airborne particles. And due to the fact that infections are the most significant cause of exacerbation, you should also take safety precautions like getting your annual flu shot and staying up-to-date about COVID-19.

The most essential components of your COPD treatment plan include supplemental oxygen therapy and pulmonary rehabilitation. Oxygen therapy will help you keep your blood oxygen levels stable wherever you go which can prevent respiratory failure and pulmonary rehabilitation will keep your lungs and muscles working efficiently making it easier to breathe.

Learn About Social Security Disability Benefits

Old-age, Survivors, and Disability Insurance (OASDI) is the official name for “social security benefits” in the US. This program is funded by the Federal Insurance Contributions Act (FICA) taxes made by employees and matched by employers. According to the official Social Security website, Social Security benefits play a crucial role in the economic well-being of millions of Americans. So, when it comes to managing your finances with COPD, it’s important to know what your social security benefits allowance is.

The social security administration defines a disability as any condition that prevents you from participating in “substantial gainful activity” for 12 months or more. In other words, if you are unable to work due to severe respiratory symptoms you should start collecting social security in order to help you pay for medical expenses. However, in order to determine whether COPD is severe enough to warrant SS benefits, they use something called the “Blue Book.” COPD is listed under section 3.02.

In order to qualify for social security benefits, you also need evidence of your COPD diagnosis. First and foremost, you’ll have to provide a full history of your COPD including symptoms, prognosis, and physical examination results. Below are some of the test results that you should provide:

- Pulse oximetry

- Hospital records

- Spirometry results

- Lung function tests

- Supplemental oxygen prescriptions

- Imaging tests such as CT scans

- Arterial blood gas tests

{{cta('43b79c5e-6bd6-4f02-ac27-2d038d20c146','justifycenter')}}

Remember that it is possible for them to deny your social security benefits claim for COPD. Because of this, it’s important to gather all the medical information you can before filling out the claim. It takes around 3 to 5 months to process your documents and let you know the results, so if you are careless in how you go about the process, you may be waiting a lot longer than expected to start receiving your benefits. Here are some tips to ensure that you’re doing the process correctly:

Fully Understand the Blue Book

The Blue Book also called the “Disability Evaluation Under Social Security” highlights medical conditions and the symptoms that need to be specified in order to receive benefits. You can either view an updated version of this book online or you can receive one in the mail which may take several weeks. This document is used as a guide book for agency officials when determining the validity of your application, so it’s important to read and understand it, especially the section that pertains to your condition.

Receive Up-to-Date Lung Function Tests

One good way to ensure that you’re receiving your full allowance is to get up-to-date tests. For example, if you received a spirometry test several years ago, you may want to consider having another test done. COPD is a progressive disease meaning it tends to get worse over time, so you want the documents you send to the SSA to reflect that.

Learn About Medical Vocational Allowance

In certain situations, it is possible for someone with severe disability to not qualify for social security benefits. However, there is something called a medical vocational allowance which can make this possible. What you’ll need to do to qualify for this is to prove that your disability has prevented you from working a job that you’ve been trained to do. Since COPD significantly impairs lung function, you should have no problem proving this if you are involved in manual labor work.

Contact a Social Security Attorney or Advocate

If you’re worried about qualifying for social security benefits or you believe you have been wrongly denied for benefits, you may consider working with a social security attorney or advocate. One of the greatest benefits of contacting an SSDI attorney is that you’re protected by something called a contingency fee arrangement. What this means is that your attorney is only allowed to charge you a fee if you win the case. What’s more, the fee is capped at 25 percent of the past-due benefits awarded to you, up to a maximum of $6,000.

Cut Costs on Medication

Medication is another area that COPD patients tend to overspend in. There are a large variety of medications that you may be required to take for COPD including bronchodilators to prevent shortness of breath, antibiotics that prevent infection and exacerbations, and anti-inflammatories which reduce flare-ups. Unfortunately, many COPD patients purchase these expensive medications without taking the time to consider how they can save money. We discussed this topic in detail in a previous post, but we’ll go over it again for your convenience.

Order Prescriptions Online

Most peoples’ gut reaction after being given a prescription is to go to their local pharmacy. While there’s nothing wrong with this approach, it will likely mean spending significantly more money on your medications. Rather, it’s often a better option to research online pharmacies because there is more competition meaning they will offer lower prices. Many online pharmacies also offer free shipping and quick turnaround times, so you shouldn’t have to wait too long to receive your medication.

Purchase Generic Brands

While you’re probably constantly bombarded with advertisements of name-brand medications, these are not the only options out there. In fact, many generic brands offer the same exact product for a much lower price. If you want to save some money, ask your doctor about generic brand medications to see if they will work for you.

Use a Patient Assistance Program (PAP)

Believe it or not, many pharmaceutical companies offer patient assistance programs designed to help low-income people pay for their medication. Oftentimes, these programs require you to make below a certain income, you must be a US citizen, and you can’t be a part of any other patient assistance program with a different pharmacy.

Ask Your Doctor for Advice

Last but certainly not least, you should always consult your doctor before making decisions about your medication. Not only will he/she have advice for you to save money on your medications, but he/she may also warn you of common pitfalls of the pharmaceutical industry. Medication is expensive these days so it’s important to take the time to understand your options.

Participate in a Clinical Trial

A clinical trial is a program designed to test the safety and efficacy of new medications and treatments before they hit the market. Clinical trials are carefully designed by medical professionals and they must be approved by the US Food and Drug Administration (FDA). These research programs depend on volunteers, so it’s very easy for anyone to sign up for one and get involved.

The benefit of participating in clinical trials for COPD is that you may be able to test new medications for free and in some cases, researchers will even pay you to participate. What’s more, the researchers will thoroughly examine your medical history to ensure the new medication doesn’t negatively interfere with your condition. Generally speaking, clinical trials are safe and they can save you hundreds or thousands on your medical expenses. It’s also nice knowing that you have the power to help researchers test new drugs and treatment procedures. If you’re interested in researching COPD clinical trials, visit clinicaltrials.gov.

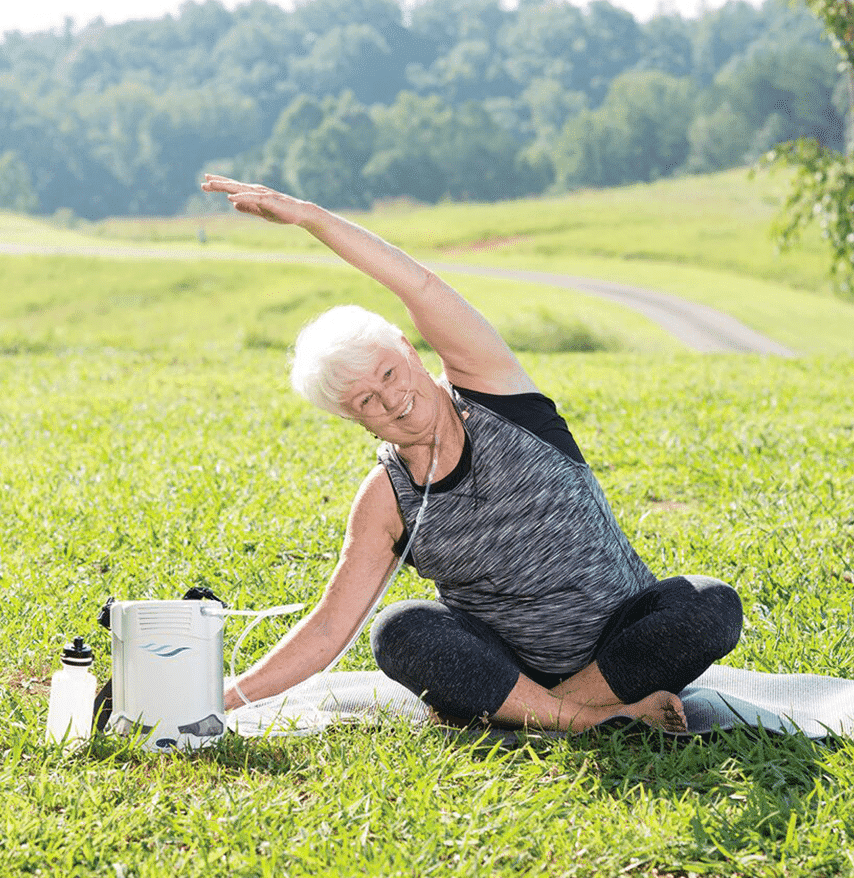

Invest in a Long-Term Oxygen Therapy Solution

Supplemental oxygen therapy is a reality for most COPD patients. Whether you have stage one COPD or stage four COPD, medical oxygen helps to ensure that your blood oxygen levels remain stable and that you can breathe easily. Unfortunately, many COPD patients take the wrong approach when it comes to purchasing a medical oxygen device and it often costs them more in the long run.

Oxygen tanks are a very popular oxygen for oxygen therapy because they are accessible and have low upfront costs. The problem, however, is that the costs add up very quickly because you have to keep refilling them. Since they run out of oxygen so quickly most people keep two or more on hand at any given time. They’re also really heavy, bulky, and dangerous to use.

Alternatively, you could invest in a long-term oxygen therapy solution like a portable oxygen concentrator. Rather than refilling oxygen concentrators as you would with an oxygen tank, these devices draw in ambient air and output medical-grade oxygen. Since these are electronic devices, all you need to do is have access to a power outlet in order to charge the batteries. Additionally, portable oxygen concentrators are extremely lightweight and easy to carry making them perfect for traveling and getting out of the house.

If you’re looking to save money in the long term and you want a powerful, reliable oxygen device, we recommend either the Caire FreeStyle Comfort or the Inogen One G5. Each of these units is 5 pounds or under, they offer over 10 hours of battery life, and they can last you between 5 and 7 years with minimal maintenance. They also have 3-year warranties which will protect you from rare occurrences like manufacturing defects.

.png)

The above portable oxygen concentrators are pulse dose delivery, meaning they deliver oxygen whenever the user inhales. In certain situations, your doctor may require you to use continuous flow instead. In this case, we recommend using the Respironics SimplyGo. This oxygen machine is not quite as light as the other two but it is the most reliable and trusted continuous flow portable oxygen concentrator on the market.

While portable oxygen concentrators have a larger upfront cost, they are always the best long-term solution. Another benefit of owning one is that if you ever decide you want to upgrade to a newer model or your doctor tells you that you no longer need oxygen, many oxygen retailers will buy back your oxygen concentrator. This is usually not possible with oxygen tanks because most oxygen companies just rent them out rather than selling them.

Speak With a Financial Advisor

Seeking out the help of a financial advisor is usually a last resort for the average person. Some financial advisors charge a pretty penny for their work and some people simply have nothing to gain from it. However, if you’re overwhelmed with financial decisions after being diagnosed with COPD and you can find the right financial expert to go to, it’s always something to consider.

A financial advisor will walk you through all of your financials and put together a long-term plan that will help you meet your goals. Oftentimes, they will tell you where to invest your money and give you a monthly allowance for what you’re allowed to spend. They’ll also help you better understand how to deal with the increasing number of medical expenses that you’re having to deal with.

Conclusion

Financial planning is something that we all have to deal with throughout our life. Taking the time to understand how much money you have and understanding where you should invest that money is crucial to living comfortably. Unfortunately, if you’re coping with a chronic lung disease like COPD, asthma, or pulmonary fibrosis, the process of planning your finances may be difficult and time-consuming.

On a positive note, if you take the time to understand your condition and some common mistakes that COPD patients make, you can avoid some major financial pitfalls. Hopefully, some of the tips listed in this article got you started on the right foot, and if they did, be sure to share it with a friend or loved one who may be struggling with the same issue.